Chris Lange, FISM News

[elfsight_social_share_buttons id=”1″]

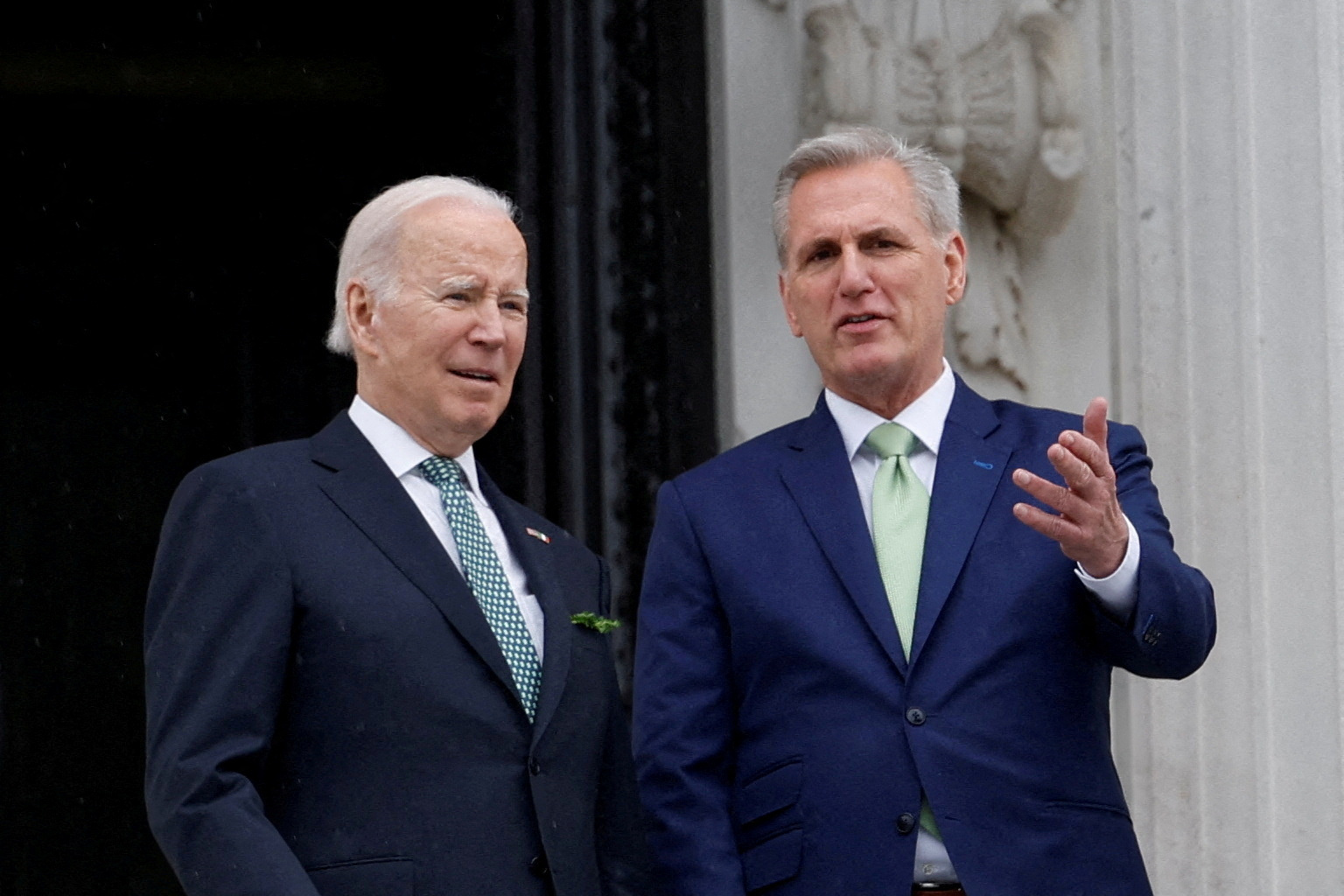

President Joe Biden has finally backed down from his position of refusing to work with Kevin McCarthy to negotiate a debt ceiling hike.

Biden called the House Speaker yesterday to arrange a meeting after Treasury Secretary Janet Yellen warned that the U.S. could default on its debts as early as June 1st.

Yellen wrote in a letter to House and Senate leaders that, if legislators do not raise or suspend the nation’s borrowing authority before that deadline, a global financial crisis will be unavoidable. She added that it is impossible to predict with certainty the exact moment the default will occur but indicated that it will be sooner than originally anticipated.

According to the Associated Press, Yellen urged congressional leaders “to protect the full faith and credit of the United States by acting as soon as possible” to address the $31.4 trillion limit on the U.S.’s legal borrowing authority.

“We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers, and negatively impact the credit rating of the United States,” Yellen wrote.

The breakthrough in the debt ceiling standoff between Biden and McCarthy is scheduled to take place on May 9, CNN reported, citing a source familiar with the situation. The president also extended the invitation to include House Minority Leader Hakeem Jeffries (D-N.Y.), Senate Majority Leader Chuck Schumer (D-N.Y.), and Senate Minority Leader Mitch McConnell (R-K.Y.).

With no support from the Democrats, the House narrowly passed McCarthy’s double-barreled package of spending cuts and a debt ceiling extension of $1.5 trillion or until March 31, 2024, whichever happens first.

President Biden had previously denounced the proposal as a “MAGA Republican wish list” and vowed to veto the legislation in the unlikely event that it cleared the Senate.

House Democrats were caught off guard by the bill’s passage in the lower chamber given months of Republican infighting over its contents. Some had begun urging the president to agree to McCarthy’s rebuffed invitations to hash out a compromise in an effort to ward off a catastrophic default.

Democratic Rep. Jared Golden said on Friday said that Biden had asked Republicans to pass something, which they did, “so it’s time to sit down and talk.”

SCHUMER TO HOLD HEARINGS ON PACKAGE TO EXPOSE ‘RADICAL AGENDA’ OF ‘MAGA REPUBLICANS’

Meanwhile, Senate Majority Leader Chuck Schumer (D.-N.Y.) on Monday rejected the bill. Schumer and his Democratic colleagues want to decouple budget cuts from a debt limit increase. To that end, Schumer announced that Senate Democrats will hold a series of hearings about the package to warn Americans about the “dangers” it poses.

“The Senate will show the public what this bill truly is,” Schumer wrote in a letter to his Democratic colleagues, as reported by Fox News. “Beginning this week, our Committees will begin to hold hearings to expose the true impact of this reckless legislation on everyday Americans.”

Schumer said the Senate Budget Committee will hold the first hearing on Thursday and called on Democrats to “make clear how devastating this proposal truly is to your constituents through public events and press.”

Schumer and House Minority Leader Hakeem Jeffries (D-N.Y.) released a joint statement on Monday declaring that “Republicans cannot allow right-wing extremism to hold our nation hostage.”

“For generations, Congress has made spending and revenue decisions as part of the annual budget process, which is currently underway,” the statement continued. Instead, the lawmakers argued, the GOP has embarked on “a hostage-situation in which extreme MAGA Republicans” are attempting “to impose their radical agenda on America. If Republicans get their way, the missive warned, the nation’s first debt default in its history will crash the stock market, increase costs for families, and threaten retirement savings.