[elfsight_social_share_buttons id=”1″]

Wall Street’s main indexes hit near two-month lows on Friday after a profit warning from global delivery bellwether FedEx spooked investors already worried about aggressive rate hikes from the Federal Reserve tipping the economy into a recession.

Adding to the somber mood, the World Bank projected that the global economy might be inching toward a recession, while the International Monetary Fund said it expected a slowdown in the third quarter.

The benchmark S&P 500 fell below the 3,900 mark, seen by many traders as a key support level, stoking speculation that there could be more selling in equity markets.

Shares of FedEx Corp plunged 22.9% and were on pace for their worst day on record after the company said a global demand slowdown accelerated at the end of August and predicted that it would worsen in the November quarter.

Rivals UPS and XPO Logistics slid 4.4% and 6.8%, respectively, while Amazon.com Inc slipped 2.9%.

All of the 11 S&P sectors declined, led by a 2.3% fall in the industrial sector. The Dow Jones Transport Average Index dropped 5.1%.

“What people are worried about is this the canary in the coal mine, we start to see some warnings from some companies across different industries suggesting outlook might be worse than we had been pricing it,” said Todd Lowenstein, chief equity strategist of the Private Bank at Union Bank.

“The market is in a sort of tug of war for the most part. On one hand, you have these rapidly deteriorating fundamentals, on the other hand, there was this what I call a misplaced hope for sort of a resurrection of the Fed pivot. The market is increasingly coming to terms that the Fed is not going to be there to save the day.”

The U.S. Fed is widely expected to deliver the third straight 75-basis-point rate hike at its meeting on Sept 20-21 after recent data failed to alter the expected course of aggressive policy tightening.

September, which is a seasonally weak period for markets, will also see the Fed ramp up the unwinding of its balance sheet to $95 billion per month, a move some investors fear may add to volatility in markets and weigh on the economy.

At 11:56 a.m. ET, the Dow Jones Industrial Average was down 301.21 points, or 0.97%, at 30,660.61, the S&P 500 was down 47.81 points, or 1.23%, at 3,853.54, and the Nasdaq Composite was down 176.13 points, or 1.52%, at 11,376.23.

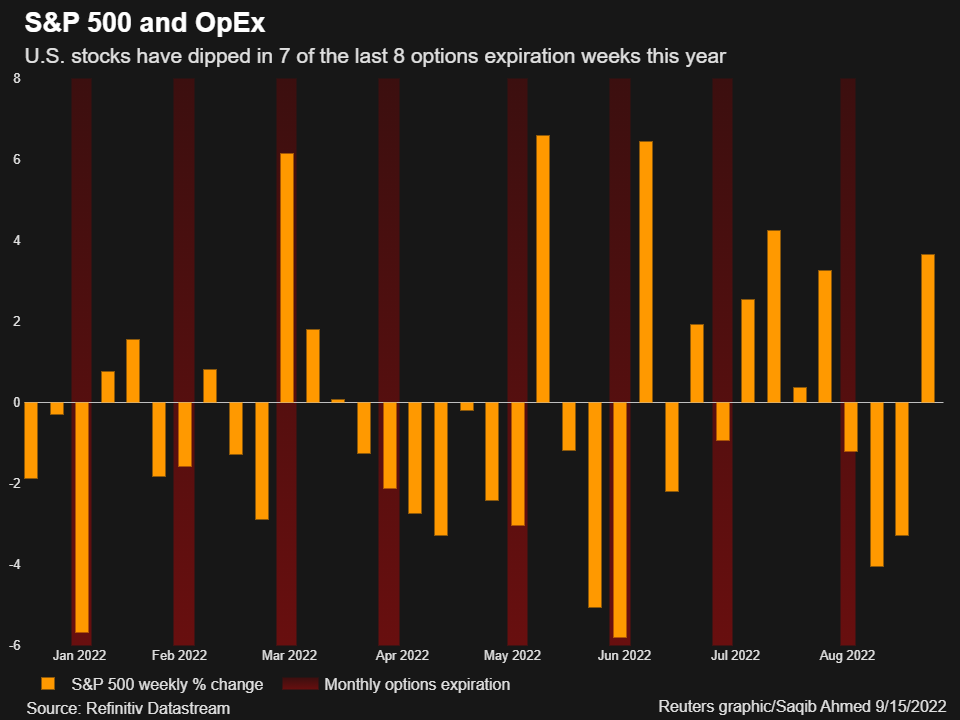

Meanwhile, the week of the monthly options expiration, ending on the third Friday of every month, has been marked by a greater-than-usual volatility this year, as options-hedging activity has amplified market moves.

Goldman Sachs strategists said in a note that about $3.2 trillion of options are set to expire on Friday, including $509 billion of single stock options.

On average, the S&P 500 has fallen 1.8% in options expiration weeks, compared with an average weekly gain of 0.09% in non-expiration weeks, according to a Reuters analysis.

The CBOE volatility index, also known as Wall Street’s fear gauge, rose to 27.27 points.

All three indexes are set for a sharp weekly fall, with the tech-heavy Nasdaq down 6.1%.

Declining issues outnumbered advancers for a 5.27-to-1 ratio on the NYSE and for a 4.04-to-1 ratio on the Nasdaq.

The S&P index recorded no new 52-week high and 53 new lows, while the Nasdaq recorded seven new highs and 281 new lows.

Copyright 2022 Thomson/Reuters