[elfsight_social_share_buttons id=”1″]

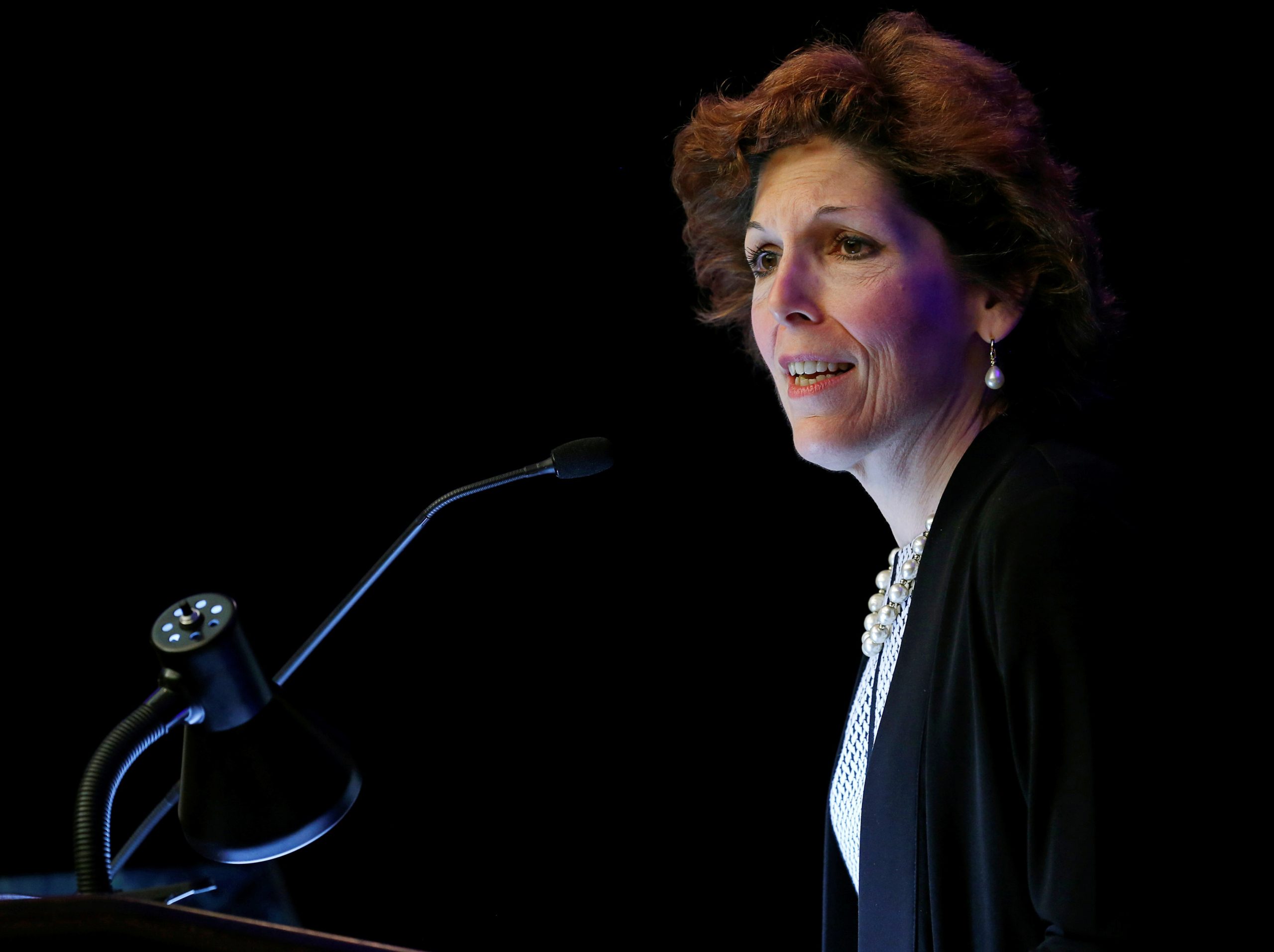

The U.S. Federal Reserve should raise interest rates to above 4% in order to bring inflation back down to target, Cleveland Fed President Loretta Mester said on Thursday.

“I would pencil in going a bit above four as appropriate,” Mester told reporters following an event held at the Economic Club of Pittsburgh, in reference to the central bank’s policy rate. “It’s not unreasonable I think to maintain that as where we’re getting to and then we’ll see.”

Mester reiterated that she will need to see several months of inflation coming back down towards the U.S. central bank’s 2% target before policymakers feel they can let up on tightening monetary policy.

“We’re going to see variation in the numbers,” Mester said. “But that won’t necessarily be compelling evidence. I personally need to see several months of inflation coming down.”

Mester’s comments come as Americans face rising debt, a second-consecutive quarter of falling GDP, and legislators fighting over legislation that, depending on who you ask, may save the economy or may just make inflation worse.

Copyright 2022 Thomson/Reuters. Additional reporting by Jacob Fuller, FISM News.