Willie R. Tubbs, FISM News

[elfsight_social_share_buttons id=”1″]

If tone deafness was a sport, President Joe Biden might be the first person enshrined in the hall of fame.

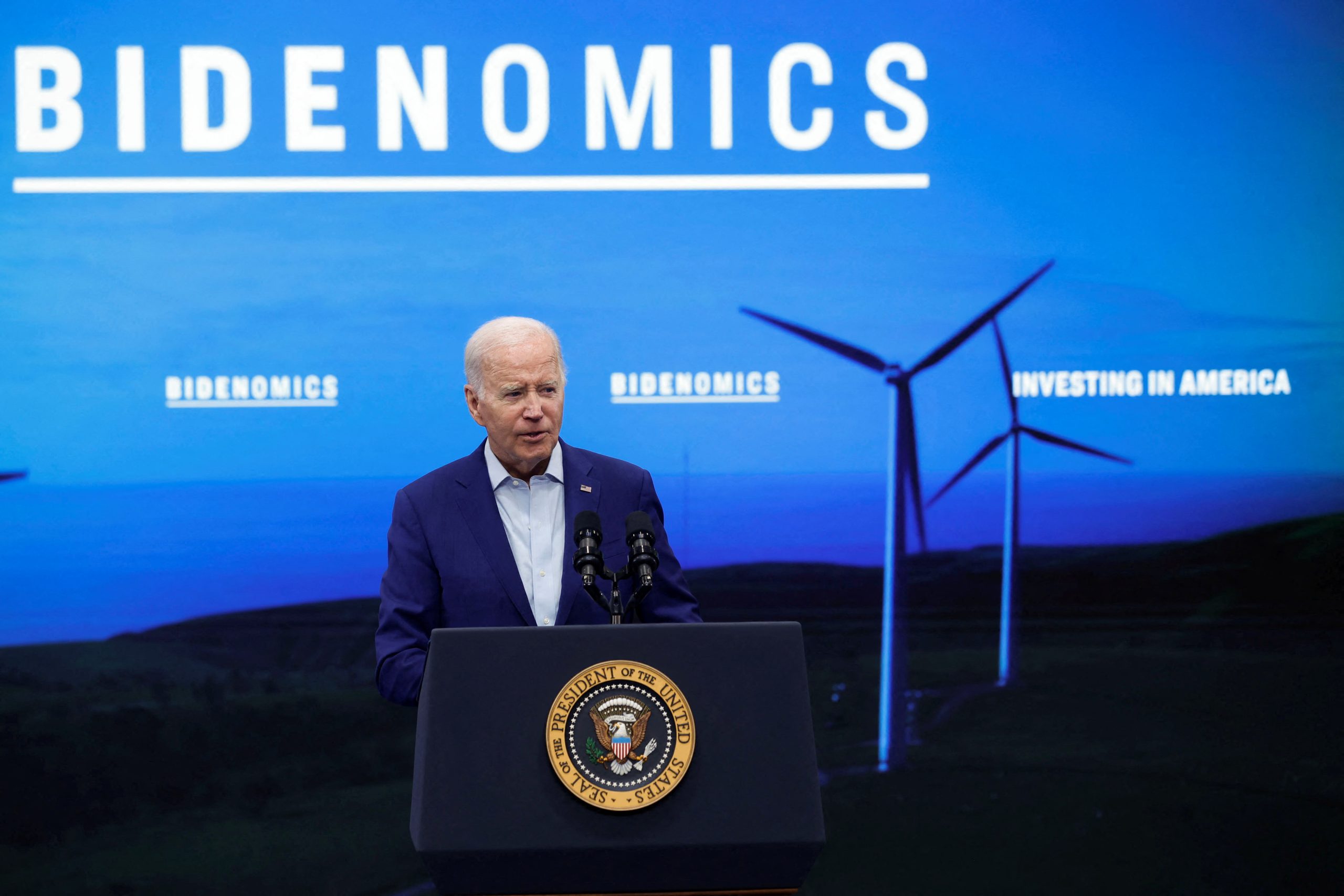

In recent weeks, the president has doubled, tripled, and quadrupled down on his skill at running the United States economy even as inflation ramps up again and news has emerged of unprecedented incurrence of debt.

“Today’s numbers show our economy remains strong,” Biden tweeted Thursday. “Annual inflation has fallen by around two thirds since last summer and real wages are up for working folks this year. We’ve done this while maintaining near record low unemployment and strong economic growth. That’s Bidenomics.”

Today’s numbers show our economy remains strong. Annual inflation has fallen by around two thirds since last summer and real wages are up for working folks this year.

We've done this while maintaining near record low unemployment and strong economic growth.

That's Bidenomics.

— President Biden (@POTUS) August 10, 2023

While Biden is accurate, his math lacks critical context. In July, after a year of steady cooling, inflation increased b 3.2 percent, according to data released Thursday by the Labor Department.

“Biden’s backward policies have driven inflation up 16.8% since he took office, leaving families in Florida paying over $1,000 more a month and struggling to get by,” Sen. Rick Scott (R-Fla.) tweeted. “Folks across the nation have suffered too long under Biden. We have to get our fiscal house in order.”

Biden’s backward policies have driven inflation up 16.8% since he took office, leaving families in Florida paying over $1,000 more a month and struggling to get by.

Folks across the nation have suffered too long under Biden. We have to get our fiscal house in order.…

— Rick Scott (@SenRickScott) August 10, 2023

But, as the president indicated, that’s Bidenomics.

Another key component of Biden’s eponymous economic plan is taking on staggering debt.

This week, the Congressional Budget Office estimated that the federal government had borrowed an additional $1.6 trillion from January-July of this year. That’s double the amount of debt incurred over the same period a year ago.

Making matters worse for everyday Americans is the fact that the CBO estimates wages are down nine percent, which not only harms the working class that is struggling to overcome inflation, but also deprives the federal government of some $313 billion in tax revenue.

Even if they were used responsibly, those tax dollars would hardly register as a blip in terms of addressing national debt, but their absence further accelerates the nation’s rush to $50 trillion in national debt.

The debt currently sits at $32 trillion, which amounts to roughly a $253,000 burden per American. However, the CBO estimates that the national debt will eclipse the half-century mark within the next 10 years.

Perhaps, again, that’s just Bidenomics. Or perhaps it’s merely in keeping with a president who has a legendary skill for doing precisely the opposite of what seems logical and reasonable.

Even after Fitch Ratings downgraded the United States’ long-term rating from AA+ to AAA, which is a telling sign of the nation’s credit with foreign currency lenders, the Biden federal government continues to borrow about $5 billion per day.

As gas prices again rise to absurd levels, Biden has ramped up his green energy rhetoric.

“President Biden is completely out-of-touch,” House Speaker Kevin McCarthy (R-Calif.) tweeted. “While gas prices skyrocket once again, he’s doing a hard-hitting interview on the Weather Channel—doubling down on the same radical, Green New Deal policies that are forcing families to pay more at the pump in the first place.”

President Biden is completely out-of-touch.

While gas prices skyrocket once again, he's doing a hard-hitting interview on the Weather Channel—doubling down on the same radical, Green New Deal policies that are forcing families to pay more at the pump in the first place.

— Kevin McCarthy (@SpeakerMcCarthy) August 9, 2023

Now – as if following its government’s lead but more accurately because of a lack of options – the American citizenry is falling farther into debt.

Student debt has been well discussed over the past year, but lesser acknowledged has been credit card debt, which impacts even more Americans and for the first time has surpassed $1 trillion.

Conservatives say it’s another sign of Bidenomics having its effect.

“This is the direct result of this Administration’s economic policies,” Rep. Mark Alford (R-Mo.) tweeted. “Cost of living in this country has gotten so high, that Americans have been forced to pile up record amounts of debt. It is time for a course correction down at 1600 Pennsylvania Ave.”

This is the direct result of this Administration's economic policies. Cost of living in this country has gotten so high, that Americans have been forced to pile up record amounts of debt.

It is time for a course correction down at 1600 Pennsylvania Ave.https://t.co/1Re241HOtd

— Mark Alford (@RepMarkAlford) August 10, 2023

One of the more interesting elements of Bidenomics, which the president hopes to ride to reelection, is that it is as unoriginal as it is checkered.

The Washington Examiner has a far more robust exploration of the topic, but President Biden’s efforts mimic those of the man under whom he served as vice president, and have produced similar results. In the same editorial, the Examiner issues a plea for the American government to return to its historic ways of handling debt and spending.

In the interim, and perhaps in perpetuity, Bidenomics will prevail.