Matt Bush, FISM News

[elfsight_social_share_buttons id=”1″]

In November 2022, the White House extended the federal student loan repayment pause to June 30, 2023. That date, according to Education Secretary Miguel Cardona, is not expected to be extended again.

“No later than June 30th, we’re going to begin that process,” Cardona said Thursday in response to a question about when the repayment pause would end. “They [borrowers] need a long on-ramp because it has been three years (without) resuming payments.”

If the repayment pause ends on June 30, borrowers would be required to begin repaying their loans 60 days later on August 29. Federal student loans would also begin accruing interest again on that date as well.

On March 20, 2020, just seven days after a national emergency was declared, then President Trump announced that his administration would suspend student loan repayment on federal loans and that no interest would be charged or would accrue on those loans for a period of six months. In August of that year, the administration extended the repayment pause, which has been extended every six months since then.

Borrowers have always been able to ask their lenders for a forbearance period on their student loans when faced with hardships or if they are unable to meet their obligations for a certain time period, but this repayment pause was different. A loan in forbearance would continue to be charged interest so that the total amount of the student loan would grow during the forbearance period.

Trump’s pause, according to a memo his office sent to the Department of Education, gave relief by “both suspending loan payments and temporarily setting interest rates to 0 percent.”

That means for the past three years, student loan borrowers have not been charged a cent of interest, and they could have paid as much or as little back on their loans over that time period without the threat of a larger payment being due.

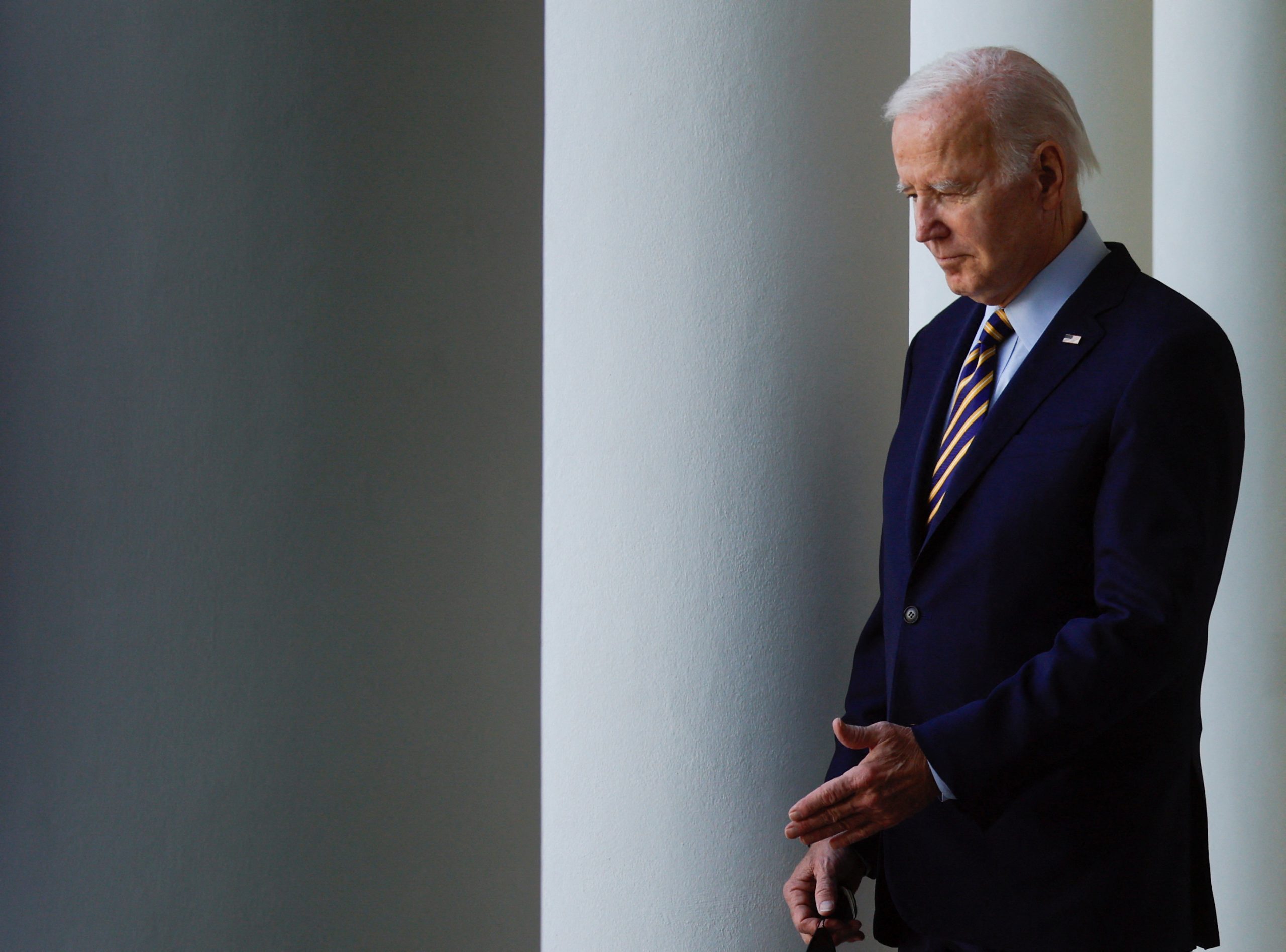

On April 10, President Biden signed a bill that terminated the national emergency over COVID-19 that Trump declared on March 13, 2020. By declaring that the national emergency is over, policies like Title 42 and the student loan repayment pause that were tied to the emergency response must logically come to an end as well.

During the 2020 presidential campaign, Biden promised to help student loan borrowers saddled with debt escape the financial hole they were in. Knowing that the repayment pause would end, the Biden administration offered a debt forgiveness plan instead.

“The Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department of Education, and up to $10,000 in debt cancellation to non-Pell Grant recipients. Borrowers are eligible for this relief if their individual income is less than $125,000 ($250,000 for married couples),” stated a fact sheet from the administration on August 24, 2022.

“We recognize that our borrowers need information and they need a long on-ramp because it has been three years of resuming payments. We’re confident, Senator, that the Supreme Court will rule in favor of the targeted debt relief, providing relief for millions of borrowers, and we want to make sure that the information that borrowers get is accurate,” Cardona said.

Many lawmakers, however, are not as confident that the debt relief will happen.

Student loan forgiveness has been blocked by the Supreme Court and seems unlikely to be instituted any time in the near future. At this point, the Biden administration has been left with no choice but to require student loan borrowers to pay back their loans, charge interest on those loans, and go back on his 2020 campaign promise.