Willie R. Tubbs, FISM News

[elfsight_social_share_buttons id=”1″]

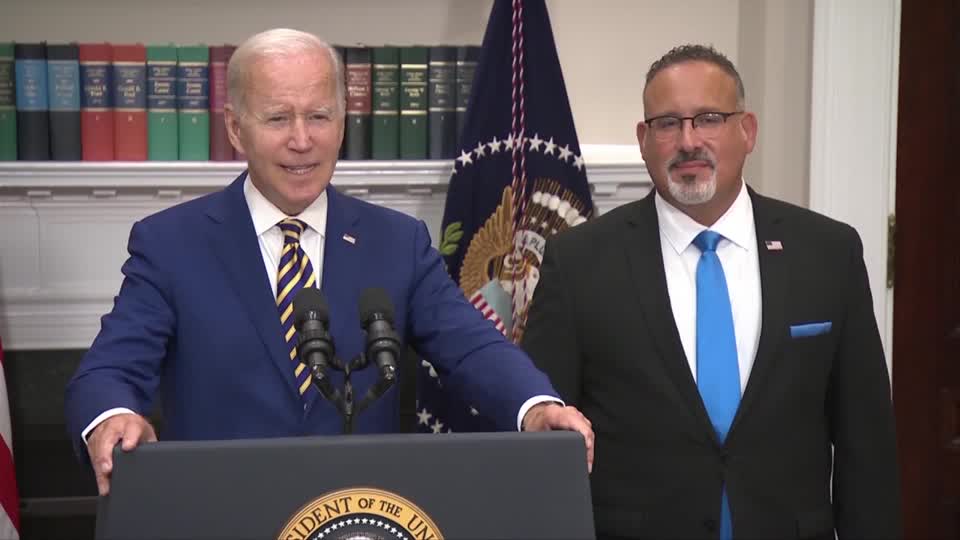

President Joe Biden demonstrated a rare skill for prescience when he announced his plan to forgive $10,000-$20,000 in student debt for millions of borrowers – his move would not be popular with everyone.

“I understand not everything I’m announcing is going to make everybody happy,” Biden said. “Some think it’s too much — I find it interesting how some of my Republican friends who voted for those tax cuts think we shouldn’t be helping these folks. Some think it’s too little, but I believe my plan is responsible and fair. It focuses the benefit of middle-class and working families, it helps both current and future borrowers, and it’ll fix a badly broken system.”

The president’s optimism does not seem to be rooted in anything deeper than a hope that confidently stating the system is fixed will make it so.

His optimism, however, was not shared by economists, some of whom have warned of dire consequences for the U.S. economy.

Even before Biden’s announcement, the Penn Wharton Budget Model, a nonpartisan undertaking at the University of Pennsylvania, predicted that a one-time forgiveness of $10,000 per borrower would cost the American taxpayer $300 billion. Had Biden opted to forgive $50,000 in student debt, the predicted cost would have been $980 billion.

The most pervasive criticism of the Biden plan has been that it will exacerbate inflation. A CNBC poll taken prior to Biden’s announcement revealed that 59% of respondents were concerned student loan forgiveness would impact the overall cost of living.

Biden has promised relief, though the math does not appear to add up.

“There is plenty of deficit reduction to pay for the programs … many times over,” Biden said.

In a depressing moment of symmetry, the Biden administration added at least $300 billion to the national debt only weeks after having attempted to sell Americans on the Inflation Reduction Act with promises that the tax hikes that accompanied it would reduce the national debt by about $310 billion and lower inflation.

Theoretically, and assuming the Inflation Reduction Act yields the tax revenue expected, the nation would be able to afford the plan, but only at break-even rates.

However, even if all of the Democrats’ claims of creating revenue streams through the Inflation Reduction Act are correct, breaking even may still be a pipe dream. The Committee for a Responsible Federal Budget released a report saying that according to their models the true cost of Biden’s student loan forgiveness plan would be between $440 and $600 billion, which would dwarf any touted savings that Democrats say the Inflation Reduction Act would bring.

Biden announced he had a plan to draw in even more revenue without adding more taxes. He believes the student loan debt holders, whose loans he announced would become unfrozen in January, would refill public coffers by paying on their loans again.

“By resuming student loan payments at the same time we provide targeted relief, we’re taking an economically responsible course,” Biden said. “As a consequence, $50 billion dollars a year will start coming back into the Treasury because of the resumption of debt.”

According to Democrats’ logic, the Inflation Reduction Act will reduce inflation — although, as previously reported on FISM, this is almost certainly not the case — but adding $300 billion in new spending will help the economy because it will be accompanied by the resumption of burdensome debt collection on many of the people to whom Biden has just allegedly given life-changing money.

Jason Furman, President Barack Obama’s chairman of the Council of Economic Advisers, likened the plan to “pouring gasoline on the inflationary fire.”

Pouring roughly half trillion dollars of gasoline on the inflationary fire that is already burning is reckless. Doing it while going well beyond one campaign promise ($10K of student loan relief) and breaking another (all proposals paid for) is even worse.

— Jason Furman (@jasonfurman) August 24, 2022

These pesky details were either lost on or wholly ignored by Democrats, who spent the day celebrating the announcement.

Sen. Elizabeth Warren (D-Mass.) seemed to have forgotten that she ran for president on promises of effectively ending student debt with $50,000 in forgiveness per borrower or was placated by seeing one-fifth of her plan come to fruition.

“Thanks to President Biden, about 27 million borrowers — the majority of Americans with student debt — can get $20,000 canceled,” Warren wrote in one of many tweets about loan forgiveness. “For 20 million Americans, that will totally wipe out their entire balance. And everyone else will get a lower monthly payment. Truly transformative.”

If Warren’s math is correct, Biden’s pool of borrowers sending money back to the federal government will have shrunk significantly. When Warren floated her $50,000 promise, the field of recipients would have been about 42 million debt holders.

Anger about the Biden plan was widespread on the right, but generally boiled down to asking who was actually going to pay for this.

Sen. Ted Cruz (R-Texas) went so far as to suggest that Biden’s decision was illegal.

“Let’s be clear – there is no way to ‘cancel’ student debt,” Cruz said in a statement. “This will cost every taxpayer an average of $2100. Someone will pay the price for this policy and the price is likely to be felt by every American in the form of even higher inflation. This administration is exceeding its legal authority and illegally burdening hard-working Americans with debts they didn’t take on themselves.”

The idea of loan forgiveness has never been popular on the right. This week, a video resurfaced from Warren’s presidential run in 2020 showing an angry father confronting her on the matter.

In the video the man angrily tells Warren that he worked two jobs to pay his daughter’s way through college so that she would not need to take on student loans. He also asks if he would get his money back.

FATHER TO SEN. ELIZABETH WARREN:

"So you're going to pay for people who didn't save any money, and those of us who did the right thing get screwed."

🔥🔥🔥

Take Action ➡️ https://t.co/uSyjQjEpM6 pic.twitter.com/rKCDE0mdPC

— ACT For America (@ACTforAmerica) August 24, 2022

Two years later, Senate Minority Leader Mitch McConnell offered a similar sentiment – loan forgiveness is inequitable for those students who sacrificed greatly to pay for their education.

“President Biden’s student loan socialism is a slap in the face to every family who sacrificed to save for college, every graduate who paid their debt, and every American who chose a certain career path or volunteered to serve in our Armed Forces in order to avoid taking on debt,” McConnell said. “This policy is astonishingly unfair.”